MERKX Merk Hard Currency Fund

Fund Description

The Merk Hard Currency Fund was liquidated in November 2022. Please download the prospectus to read the supplement on page 1 for details.

Fund Objective

The Merk Hard Currency Fund (MERKX) seeks to profit from a rise in hard currencies versus the U.S. dollar.

Overview

Below is the Fund's exposure to hard currencies as of June 30, 2022, along with the composition of the U.S. Dollar Index (USDX):

| Region | Currency | MERKX | USDX |

|---|---|---|---|

| Europe | Euro | 14.8% | 57.6% |

| Norwegian Krone | 15.7% | — | |

| Swiss Franc | — | 3.6% | |

| British Pound | 3.6% | 11.9% | |

| Swedish Krona | 10.4% | 4.2% | |

| Australasia ex Japan | Australian Dollar | 18.5% | — |

| New Zealand Dollar | 11.8% | — | |

| Singapore Dollar | — | — | |

| Japan | Japanese Yen | — | 13.6% |

| North America | Canadian Dollar | 24.5% | 9.1% |

| US Dollar | — | — | |

| Gold | Gold | 0.8% | — |

The Fund's security holdings as of June 30, 2022 are shown below:

| Holding | Currency | Maturity | Percent of Portfolio |

|---|---|---|---|

| ALBERTA PROVINCE 1.60% | CAD | 9/1/22 | 5.0% |

| AUSTRALIAN GOVERNMENT 2.25% | AUD | 11/21/22 | 5.8% |

| CANADIAN TREASURY BILL | CAD | 7/21/22 | 4.9% |

| CITY OF OSLO NORWAY | NOK | 4/3/24 | 2.1% |

| CITY OF OSLO NORWAY | NOK | 5/24/23 | 2.2% |

| EFSF 1.875% | EUR | 5/23/23 | 4.4% |

| KOMMUNINVEST I SVERIGE 0.75% | SEK | 2/22/23 | 10.3% |

| NEW BRUNSWICK PROVINCE 2.85% | CAD | 6/2/23 | 4.5% |

| NEW SOUTH WALES TREASURY CORP 4.00% | AUD | 4/20/23 | 2.6% |

| NEW ZEALAND GOVERNMENT 5.50% | NZD | 4/15/23 | 11.3% |

| NORWEGIAN TREASURY BILL | NOK | 12/21/22 | 10.0% |

| PROVINCE OF BRITISH COLUMBIA 2.70% | CAD | 12/18/22 | 4.2% |

| QUEENSLAND TREASURY CORP 6.00% | AUD | 7/21/22 | 4.8% |

| REPUBLIC OF AUSTRIA 0% | EUR | 4/20/23 | 4.5% |

| SASKATHEWAN PROVINCE 3.20% | CAD | 6/3/24 | 4.9% |

| TREASURY CORP VICTORIA 6.00% | AUD | 10/17/22 | 2.6% |

| U.S. TREASURY | USD | 7/21/22 | 6.5% |

| VANECK MERK GOLD SHARES | GOLD | 0.8% |

The Fund accepts investments in the following minimum amounts:

| Minimum Initial Investment | Minimum Additional Investment | |

|---|---|---|

| Standard Accounts | $2,500 | $100 |

| Traditional and Roth IRA Accounts | $1,000 | $100 |

Fund Information

Ticker

MERKX

Expense Ratio

1.32%

Assets

Assets reflect investor and institutional shares combined.

$46.3 million (as of 06/30/22)

Dividends

Duration

To mitigate interest rate and credit risk to its portfolio, the Fund typically maintains a weighted average portfolio maturity of less than eighteen months.

0.57 years

Fund Inception

May 10th, 2005

Load

No-Load Fund

Institutional Shares

Merk Funds provides an institutional share class for the Merk Hard Currency Fund (MHCIX). The institutional shares eliminate the 12b-1 fee and have a minimum investment of $250,000, which may be aggregated across multiple client accounts for advisers.

Available

Portfolio Managers

President & Chief Investment Officer

Supported by the Investment Management Team

Below is the Fund's exposure to hard currencies as of June 30, 2022, along with the composition of the U.S. Dollar Index (USDX):

| Region | Currency | MERKX | USDX |

|---|---|---|---|

| Europe | Euro | 14.8% | 57.6% |

| Norwegian Krone | 15.7% | — | |

| Swiss Franc | — | 3.6% | |

| British Pound | 3.6% | 11.9% | |

| Swedish Krona | 10.4% | 4.2% | |

| Australasia ex Japan | Australian Dollar | 18.5% | — |

| New Zealand Dollar | 11.8% | — | |

| Singapore Dollar | — | — | |

| Japan | Japanese Yen | — | 13.6% |

| North America | Canadian Dollar | 24.5% | 9.1% |

| US Dollar | — | — | |

| Gold | Gold | 0.8% | — |

The Fund's security holdings as of June 30, 2022 are shown below:

| Holding | Currency | Maturity | Percent of Portfolio |

|---|---|---|---|

| ALBERTA PROVINCE 1.60% | CAD | 9/1/22 | 5.0% |

| AUSTRALIAN GOVERNMENT 2.25% | AUD | 11/21/22 | 5.8% |

| CANADIAN TREASURY BILL | CAD | 7/21/22 | 4.9% |

| CITY OF OSLO NORWAY | NOK | 4/3/24 | 2.1% |

| CITY OF OSLO NORWAY | NOK | 5/24/23 | 2.2% |

| EFSF 1.875% | EUR | 5/23/23 | 4.4% |

| KOMMUNINVEST I SVERIGE 0.75% | SEK | 2/22/23 | 10.3% |

| NEW BRUNSWICK PROVINCE 2.85% | CAD | 6/2/23 | 4.5% |

| NEW SOUTH WALES TREASURY CORP 4.00% | AUD | 4/20/23 | 2.6% |

| NEW ZEALAND GOVERNMENT 5.50% | NZD | 4/15/23 | 11.3% |

| NORWEGIAN TREASURY BILL | NOK | 12/21/22 | 10.0% |

| PROVINCE OF BRITISH COLUMBIA 2.70% | CAD | 12/18/22 | 4.2% |

| QUEENSLAND TREASURY CORP 6.00% | AUD | 7/21/22 | 4.8% |

| REPUBLIC OF AUSTRIA 0% | EUR | 4/20/23 | 4.5% |

| SASKATHEWAN PROVINCE 3.20% | CAD | 6/3/24 | 4.9% |

| TREASURY CORP VICTORIA 6.00% | AUD | 10/17/22 | 2.6% |

| U.S. TREASURY | USD | 7/21/22 | 6.5% |

| VANECK MERK GOLD SHARES | GOLD | 0.8% |

The Fund accepts investments in the following minimum amounts:

| Minimum Initial Investment | Minimum Additional Investment | |

|---|---|---|

| Standard Accounts | $2,500 | $100 |

| Traditional and Roth IRA Accounts | $1,000 | $100 |

BECOME A PART OF THE

MERK COMMUNITY

Subscribe to our regular reports and research,

as well as all updates relating to MERK

Currency symbols: AUD Australian dollar; CAD Canadian dollar; CHF Swiss Franc; EUR euro; GBP British pound; JPY Japanese yen; NOK Norwegian krone; NZD New Zealand dollar; SGD Singapore dollar; SEK Swedish krona; USD U.S. dollar

Fund holdings are subject to change without notice.

Currency exposure includes unsettled trades, market or accrued cost value of debt securities held, money market deposit account, capital shares sold, accrued income, as well as effective exposure through currency forward contracts, if applicable. US Dollar, net, includes net other assets and liabilities. All percentages are of total net assets. Top holdings currency exposure is before settlements, if any. Sector allocation adheres to balance sheet classifications and makes no adjustment for gold futures exposure. Please also consult with the latest annual or semi-annual report for complete information on assets, liabilities and applicable notes as of the publication date for the respective reports.

The ICE U.S. Dollar Index® (USDX) is a trade-weighted geometric average of the U.S. dollar’s value compared to a basket of six major global currencies (euro, Japanese yen, British pound, Canadian dollar, Swedish krona, Swiss franc) set by the ICE (IntercontinentalExchange) Futures US. It is not possible to invest directly in an index.

As with any mutual fund product, there is no guarantee that the fund will achieve its goals. Investment return and principal value will vary and shares may be worth more or less at redemption than at original purchase; the Fund is not a substitute for a money market fund. Investors should consider the investment objectives, risks and charges and expenses of the Merk Hard Currency Fund carefully before investing.

The prospectus contains this and other information about the Merk Hard Currency Fund. To obtain a prospectus, please download it now or call (866) MERK FUND. The prospectus should be read carefully before investing.

Merk Hard Currency Fund Disclosure:

The material must be preceded or accompanied by a prospectus. Before investing you should carefully consider the VanEck Merk Gold Trust's ("Trust") investment objectives, risks, charges and expenses.

Investing involves risk, including possible loss of principal. The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity pool for the purposes of the Commodity Exchange Act. Shares of the Trust are not subject to the same regulatory requirements as mutual funds. Because shares of the Trust are intended to reflect the price of the gold held in the Trust, the market price of the shares is subject to fluctuations similar to those affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value (“NAV”). Brokerage commissions will reduce returns.

The request for redemption of shares for gold is subject to a number of risks including but not limited to the potential for the price of gold to decline during the time between the submission of the request and delivery. Delivery may take a considerable amount of time depending on your location.

Commodities and commodity-index linked securities may be affected by changes in overall market movements and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities.

Trust shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of Trust shares relates directly to the value of the gold held by the Trust (less its expenses), and fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them. The Trust does not generate any income, and as the Trust regularly issues shares to pay for the Sponsor’s ongoing expenses, the amount of gold represented by each Share will decline over time. Investing involves risk, and you could lose money on an investment in the Trust. For a more complete discussion of the risk factors relative to the Trust, carefully read the prospectus.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

The sponsor of the Trust is Merk Investments LLC (the “Sponsor”). VanEck provides marketing services to the Trust.

All rights reserved. All trademarks, service marks or registered trademarks are the property of their respective owners.

VanEck Merk Gold Trust Disclosure:

The material must be preceded or accompanied by a prospectus. Before investing, you should carefully consider the VanEck Merk Gold Trust's ("Trust") investment objectives, risks, charges, and expenses.

Investing involves risk, including possible loss of principal. The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity pool for the purposes of the Commodity Exchange Act. Shares of the Trust are not subject to the same regulatory requirements as mutual funds. Because shares of the Trust are intended to reflect the price of the gold held in the Trust, the market price of the shares is subject to fluctuations similar to those affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value (“NAV”). Brokerage commissions will reduce returns.

The request for redemption of shares for gold is subject to a number of risks including but not limited to the potential for the price of gold to decline during the time between the submission of the request and delivery. Delivery may take a considerable amount of time depending on your location.

Commodities and commodity-index linked securities may be affected by changes in overall market movements and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities.

Trust shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of Trust shares relates directly to the value of the gold held by the Trust (less its expenses), and fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them. The Trust does not generate any income, and as the Trust regularly issues shares to pay for the Sponsor’s ongoing expenses, the amount of gold represented by each Share will decline over time. Investing involves risk, and you could lose money on an investment in the Trust. For a more complete discussion of the risk factors relative to the Trust, carefully read the prospectus.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

The sponsor of the Trust is Merk Investments LLC (the “Sponsor”). VanEck provides marketing services to the Trust.

All rights reserved. All trademarks, service marks or registered trademarks are the property of their respective owners.

This internet site is not an offer to sell or a solicitation of an offer to buy shares of the Funds to any person in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Furthermore, this site contains links to third party websites on the internet. The inclusion of such links on the site are not endorsement by the Funds, implied or otherwise, of the linked site or any products or services in such sites, and no information in such site has been endorsed or approved by the Funds.

The linked sites are not under the control of the Funds, and the Funds are not responsible for the contents of any linked site or any link contained in a linked site. For additional information pertaining to the use of this site, refer to the Terms and Conditions of Use link found below.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully. Foreside Fund Services, LLC, distributor.

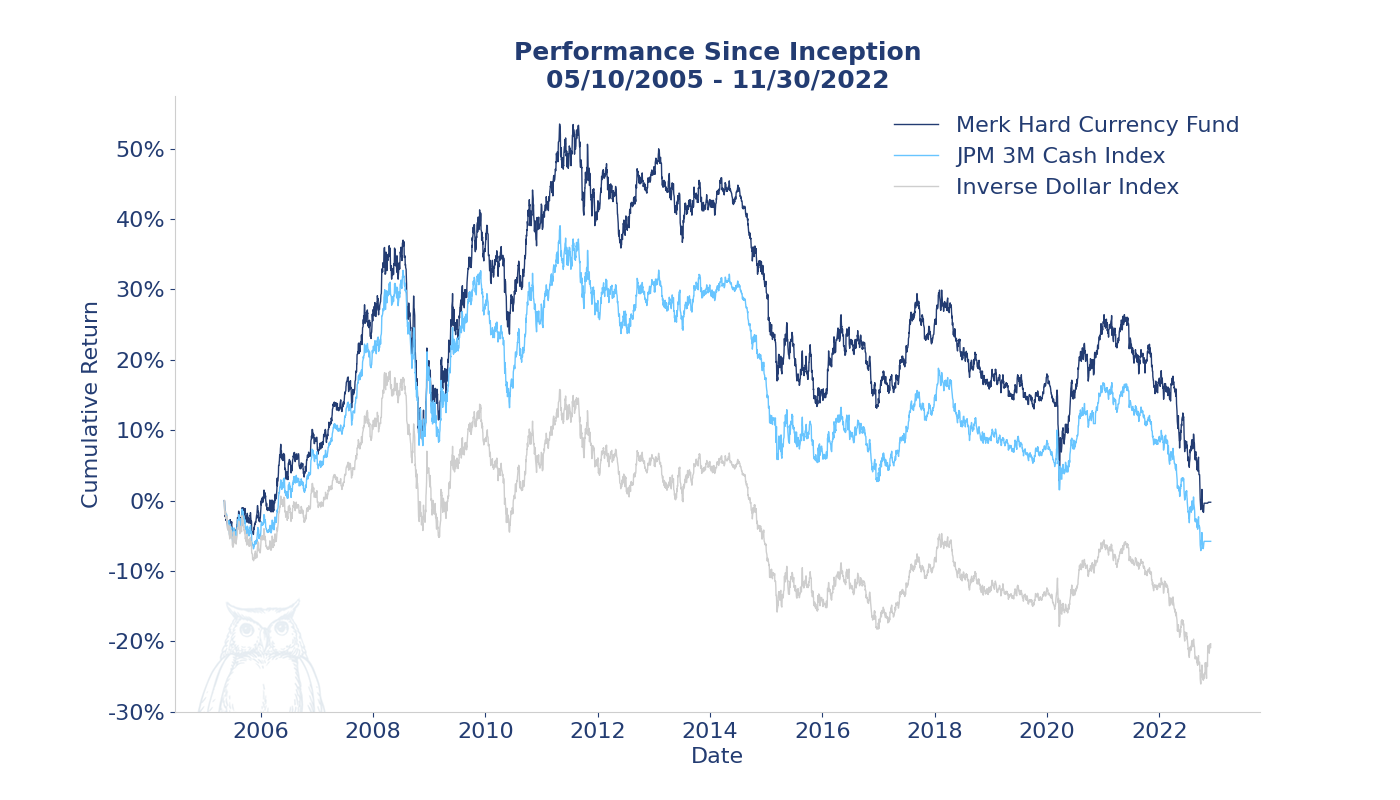

Performance

The Merk Hard Currency Fund invests in a managed basket of hard currencies from countries with sound monetary policies.

This strategy seeks to profit from a rise in hard currencies relative to the U.S. dollar, which may help to diversify your portfolio, and potentially decreases downside risk against a decline in the dollar.

The Merk Hard Currency Fund provides access to these currencies, while seeking to mitigate stock market, credit and interest rate risks incurred by alternative means of access, such as the typical international equity or bond fund.

The performance numbers below are for Investor Shares.

Month End: As of November 30, 2022

| YTD | 1 year | Since inception 5/10/05 (Cumulative Returns) |

|

|---|---|---|---|

| MERKX | -15.03% | -14.25% | -0.22% |

| Inverse of USDX | -13.66% | -12.88% | -5.78% |

| JPM 3M Cash Index | -9.76% | -9.53% | -20.34% |

Quarter End: As of November 30, 2022 (annualized returns)

| 1 year | 5 year | 10 year | Since inception 5/10/05 | |

|---|---|---|---|---|

| MERKX | -14.25% | -4.20% | -3.71% | -0.01% |

| Inverse of USDX | -12.88% | -3.67% | -3.15% | -0.34% |

| JPM 3M Cash Index | -9.53% | -2.58% | -2.76% | -1.29% |

Calendar Year Performance

| MERKX | Inverse of USDX | JPM 3M Cash Index | |

|---|---|---|---|

| 2021 | -6.37% | -5.99% | -6.30% |

| 2020 | 6.27% | 7.17% | 7.29% |

| 2019 | 0.87% | -0.22% | -0.53% |

| 2018 | -6.33% | -4.21% | -4.78% |

| 2017 | 9.08% | 10.95% | 10.24% |

| 2016 | -0.33% | -3.50% | -2.86% |

| 2015 | -12.08% | -8.48% | -7.94% |

| 2014 | -8.94% | -11.34% | -10.37% |

| 2013 | -2.76% | -0.33% | -0.04% |

| 2012 | 4.11% | 0.51% | 2.27% |

| 2011 | -0.77% | -1.43% | 0.77% |

| 2010 | 4.63% | -1.48% | 0.25% |

| 2009 | 13.84% | 4.43% | 9.00% |

| 2008 | -4.94% | -5.67% | -3.22% |

| 2007 | 15.18% | 9.06% | 13.79% |

| 2006 | 11.67% | 8.99% | 12.13% |

Dividend History

The Fund declares distributions from net investment income quarterly. Any net capital gain realized by the Fund will be distributed at least annually.

Net investment income includes, amongst others, interest income net of Fund expenses. Foreign exchange gains and losses may influence net investment income. As a result, the net investment income paid and the Fund's yield as published in databases may not be a reflection of the yields of securities invested in.

Separately, when there are foreign exchange losses, the net income distributed may be significantly reduced or eliminated. Also note that foreign exchange gains may be offset by foreign exchange losses later in the year; as a consequence, and influenced by IRS rules, the bulk of realized currency gains will factor into net income distributions in December (end of calendar year) and March (end of fiscal year).

| Record Date | Ex Date | Pay Date | Investor Shares | Institutional Shares | |

|---|---|---|---|---|---|

| Income | 9/28/22 | 9/29/22 | 9/30/22 | $0.00 | $0.00 |

| Income | 6/28/22 | 6/29/22 | 6/30/22 | $0.00 | $0.00 |

| Income | 3/29/22 | 3/30/22 | 3/31/22 | $0.00 | $0.00 |

| Income | 12/29/21 | 12/30/21 | 12/31/21 | $0.22 | $0.24 |

| Short Term | 12/13/21 | 12/14/21 | 12/15/21 | $0.00 | $0.00 |

| Long Term | 12/13/21 | 12/14/21 | 12/15/21 | $0.00 | $0.00 |

| Income | 9/28/21 | 9/29/21 | 9/30/21 | $0.00 | $0.00 |

| Income | 6/28/21 | 6/29/21 | 6/30/21 | $0.00 | $0.00 |

| Income | 3/29/21 | 3/30/21 | 3/31/21 | $0.00 | $0.00 |

| Income | 12/29/20 | 12/30/20 | 12/31/20 | $0.00 | $0.00 |

| Short Term | 12/10/20 | 12/11/20 | 12/14/20 | $0.00 | $0.00 |

| Long Term | 12/10/20 | 12/11/20 | 12/14/20 | $0.00 | $0.00 |

| Income | 9/28/20 | 9/29/20 | 9/30/20 | $0.00 | $0.00 |

| Income | 6/26/20 | 6/29/20 | 6/30/20 | $0.00 | $0.00 |

| Income | 3/27/20 | 3/30/20 | 3/31/20 | $0.00 | $0.00 |

| Income | 12/27/19 | 12/30/19 | 12/31/19 | $0.00 | $0.00 |

| Short Term | 12/12/19 | 12/13/19 | 12/16/19 | $0.00 | $0.00 |

| Long Term | 12/12/19 | 12/13/19 | 12/16/19 | $0.00 | $0.00 |

| Income | 9/26/19 | 9/27/19 | 9/30/19 | $0.00 | $0.00 |

| Income | 6/26/19 | 6/27/19 | 6/28/19 | $0.00 | $0.00 |

| Income | 3/27/19 | 3/28/19 | 3/29/19 | $0.00 | $0.00 |

| Income | 12/27/18 | 12/28/18 | 12/31/18 | $0.00 | $0.00 |

| Income | 9/26/18 | 9/27/18 | 9/28/18 | $0.00 | $0.00 |

| Income | 6/27/18 | 6/28/18 | 6/29/18 | $0.08 | $0.09 |

| Income | 3/27/18 | 3/28/18 | 3/29/18 | $0.09 | $0.12 |

| Income | 12/27/17 | 12/28/17 | 12/29/17 | $0.00 | $0.00 |

| Short Term | 12/14/17 | 12/15/17 | 12/18/17 | $0.00 | $0.00 |

| Long Term | 12/14/17 | 12/15/17 | 12/18/17 | $0.00 | $0.00 |

| Income | 9/27/17 | 9/28/17 | 9/29/17 | $0.00 | $0.00 |

| Income | 6/28/17 | 6/29/17 | 6/30/17 | $0.00 | $0.00 |

| Income | 3/29/17 | 3/30/17 | 3/31/17 | $0.00 | $0.00 |

| Income | 12/28/16 | 12/29/16 | 12/30/16 | $0.00 | $0.00 |

| Short Term | 12/14/16 | 12/15/16 | 12/16/16 | $0.00 | $0.00 |

| Long Term | 12/14/16 | 12/15/16 | 12/16/16 | $0.00 | $0.00 |

| Income | 9/28/16 | 9/29/16 | 9/30/16 | $0.00 | $0.00 |

| Income | 6/28/16 | 6/29/16 | 6/30/16 | $0.00 | $0.00 |

| Income | 3/29/16 | 3/30/16 | 3/31/16 | $0.00 | $0.00 |

| Income | 12/29/15 | 12/30/15 | 12/31/15 | $0.00 | $0.00 |

| Short Term | 12/14/15 | 12/15/15 | 12/16/15 | $0.00 | $0.00 |

| Long Term | 12/14/15 | 12/15/15 | 12/16/15 | $0.00 | $0.00 |

| Income | 9/28/15 | 9/29/15 | 9/30/15 | $0.00 | $0.00 |

| Income | 6/26/15 | 6/29/15 | 6/30/15 | $0.00 | $0.00 |

| Income | 3/27/15 | 3/30/15 | 3/31/15 | $0.00 | $0.00 |

| Income | 12/29/14 | 12/30/14 | 12/31/14 | $0.00 | $0.00 |

| Short Term | 12/11/14 | 12/12/14 | 12/15/14 | $0.00 | $0.00 |

| Long Term | 12/11/14 | 12/12/14 | 12/15/14 | $0.00 | $0.00 |

| Income | 9/26/14 | 9/29/14 | 9/30/14 | $0.00 | $0.00 |

| Income | 6/26/14 | 6/27/14 | 6/30/14 | $0.08 | $0.09 |

| Income | 3/27/14 | 3/28/14 | 3/31/14 | $0.06 | $0.07 |

| Income | 12/27/13 | 12/30/13 | 12/31/13 | $0.00 | $0.00 |

| Short Term | 12/11/13 | 12/12/13 | 12/13/13 | $0.00 | $0.00 |

| Long Term | 12/11/13 | 12/12/13 | 12/13/13 | $0.00 | $0.00 |

| Income | 9/26/13 | 9/27/13 | 9/30/13 | $0.00 | $0.00 |

| Income | 6/26/13 | 6/27/13 | 6/28/13 | $0.00 | $0.00 |

| Income | 3/26/13 | 3/27/13 | 3/28/13 | $0.00 | $0.00 |

| Income | 12/27/12 | 12/28/12 | 12/31/12 | $0.00 | $0.00 |

| Short Term | 12/12/12 | 12/13/12 | 12/14/12 | $0.00 | $0.00 |

| Long Term | 12/12/12 | 12/13/12 | 12/14/12 | $0.11 | $0.11 |

| Income | 9/26/12 | 9/27/12 | 9/28/12 | $0.00 | $0.00 |

| Income | 6/27/12 | 6/28/12 | 6/29/12 | $0.00 | $0.00 |

| Income | 3/28/12 | 3/29/12 | 3/30/12 | $0.00 | $0.00 |

| Income | 12/28/11 | 12/29/11 | 12/30/11 | $0.10 | $0.11 |

| Short Term | 12/12/11 | 12/13/11 | 12/14/11 | $0.02 | $0.02 |

| Long Term | 12/12/11 | 12/13/11 | 12/14/11 | $0.16 | $0.16 |

| Income | 9/28/11 | 9/29/11 | 9/30/11 | $0.00 | $0.00 |

| Income | 6/28/11 | 6/29/11 | 6/30/11 | $0.05 | $0.06 |

| Income | 3/29/11 | 3/30/11 | 3/31/11 | $0.05 | $0.07 |

| Income | 12/29/10 | 12/30/10 | 12/31/10 | $0.00 | $0.00 |

| Short Term | 12/8/10 | 12/9/10 | 12/10/10 | $0.01 | $0.01 |

| Long Term | 12/8/10 | 12/9/10 | 12/10/10 | $0.12 | $0.12 |

| Income | 9/28/10 | 9/29/10 | 9/29/10 | $0.00 | $0.00 |

| Income | 6/28/10 | 6/29/10 | 6/29/10 | $0.07 | $0.08 |

| Income | 3/29/10 | 3/30/10 | 3/30/10 | $0.07 | |

| Income | 12/29/09 | 12/30/09 | 12/30/09 | $0.07 | |

| Capital Gains | 12/9/09 | 12/10/09 | 12/11/09 | $0.07 | |

| Income | 9/28/09 | 9/30/09 | 9/30/09 | $0.00 | |

| Income | 6/26/09 | 6/29/09 | 6/29/09 | $0.00 | |

| Income | 3/27/09 | 3/30/09 | 3/30/09 | $0.00 | |

| Income | 12/30/08 | 12/31/08 | 12/31/08 | $0.00 | |

| Capital Gains | 12/9/08 | 12/10/08 | 12/10/08 | $0.03 | |

| Income | 9/26/08 | 9/29/08 | 9/29/08 | $0.00 | |

| Income | 6/26/08 | 6/27/08 | 6/27/08 | $0.15 | |

| Income | 3/27/08 | 3/28/08 | 3/28/08 | $0.20 | |

| Income | 12/28/07 | 12/31/07 | 12/31/07 | $0.42 | |

| Capital Gains | 12/11/07 | 12/12/07 | 12/12/07 | $0.03 | |

| Income | 9/27/07 | 9/28/07 | 9/28/07 | $0.05 | |

| Income | 6/28/07 | 6/29/07 | 6/29/07 | $0.06 | |

| Income | 3/29/07 | 3/30/07 | 3/30/07 | $0.09 | |

| Income | 12/28/06 | 12/29/06 | 12/29/06 | $0.21 | |

| Capital Gains | 12/11/06 | 12/12/06 | 12/12/06 | $0.00 | |

| Income | 9/28/06 | 9/29/06 | 9/29/06 | $0.04 | |

| Income | 6/29/06 | 6/30/06 | 6/30/06 | $0.02 | |

| Capital Gains | 12/12/05 | 12/13/05 | 12/13/05 | $0.01 |

†The Merk Hard Currency Fund re-designated 1.91% and 12.81% of total 2008 net investment income distributions as short-term capital gain and long-term capital gain, respectively. This information is provided for informational purposes only and should not be used for tax reporting.

Performance data represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost.

BECOME A PART OF THE

MERK COMMUNITY

Subscribe to our regular reports and research,

as well as all updates relating to MERK

The ICE U.S. Dollar Index® (USDX) is a trade-weighted geometric average of the U.S. dollar’s value compared to a basket of six major global currencies (euro, Japanese yen, British pound, Canadian dollar, Swedish krona, Swiss franc) set by the ICE (IntercontinentalExchange) Futures US. It is not possible to invest directly in an index.

The J.P. Morgan 3-Month Global Cash Index (expressed in USD) is an equal-weighted aggregate of the cash indices of 13 countries. Each country's cash index measures the total return of a notional, rolling, daily investment in a 3-month constant maturity deposit in such country's currency. Indices cannot be purchased directly by investors.

As with any investment strategy, there is no guarantee we will achieve this goal and the strategy may not be suitable for every investor. The Fund is not a substitute for a money market fund. The prospectus should be read carefully before investing.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully. Foreside Fund Services, LLC, distributor.

Investment Process

Under normal market conditions, the Fund invests at least 80% of the value of its net assets (plus borrowings for investment purposes) in “hard currency” denominated investments. Hard currencies are currencies of countries pursuing what Merk Investments LLC (the “Adviser”) believes to be “sound” monetary policy and gold.

Sound monetary policy is defined by the Adviser as providing an environment fostering long-term price stability. Due to the intrinsic value of gold, the Adviser considers gold to qualify as a hard currency.

The Fund normally invests in a managed basket of hard currency denominated, high quality, short-term debt instruments, including sovereign debt and gold. To the extent that the Fund invests in gold, it will normally do so indirectly through U.S. listed exchange-traded products (“ETPs”) that invest in gold bullion and futures contracts, including ETPs sponsored by the Adviser or its affiliates.

BECOME A PART OF THE

MERK COMMUNITY

Subscribe to our regular reports and research,

as well as all updates relating to MERK

The Adviser will determine currency allocations based on its analysis of monetary policies pursued by central banks and economic environments. The Adviser may adapt the currency allocations as its analysis of monetary policies and economic environments evolves.

The Fund will specifically seek exposure to currencies of countries pursuing what the Adviser believes to be sound monetary policies. As long-term price stability is unlikely to be achieved by most currencies, if any, however, the Adviser may focus on countries with monetary policies that, in the Adviser’s view, better foster such stability. The Fund may from time to time focus its investment in just a few currencies.

To mitigate interest rate and credit risk, the Fund’s fixed income holdings typically have a weighted average portfolio maturity of less than eighteen months. In addition, the Fund only buys money market or other short-term debt instruments that are rated in the top three rating categories by one or more U.S. nationally recognized services or that the Adviser considers to be comparable in quality to such instruments. When selecting debt securities for the portfolio, the Adviser may sacrifice yield for high credit quality.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully. Foreside Fund Services, LLC, distributor.

Frequently Asked Questions

FAQ

The Merk Hard Currency Fund is a mutual fund that invests in a basket of hard currencies from countries with sound monetary policies assembled to protect against a decline in the dollar while seeking to mitigate stock market, credit and interest risks.

Investments in hard currencies seek to protect against a fall in the purchasing power of the dollar and mitigate stock market, credit and interest rate risk.

A classic asset allocation model assumes world financial markets in balance. When the global financial imbalances are severe, asset classes may not perform as historically anticipated. In these times, investors may want to consider moving some of their investments to hard currency.

Investment in hard currency seek to protect against a fall in the purchasing power of the dollar and mitigates stock market, credit and interest rate risk.

Diversification is the practice of reducing investment risk by spreading assets over several categories of investments. The Merk Hard Currency Fund helps you to diversify your portfolio and protect your capital against a decline in the dollar by providing easy access, through the fund, to hard currencies from countries with sound monetary policies.

Under normal market conditions, the Merk Hard Currency Fund invests at least 80% of the value of its net assets in hard currencies. The Fund normally invests in a basket of foreign currencies composed of high-quality, short-term money market instruments of countries pursuing “sound” monetary policy, and indirectly in gold. Currency allocations may be adapted as monetary policies and economic environments evolve.

The Merk Funds publish their currency allocations quarterly; this allocation adapts as our analyses evolve. We use the term "adapt" and "evolve" to emphasize that allocation changes tend to be gradual. Tactical trading refers to short-term trading to take advantage of perceived opportunities. While the Fund is not prevented from engaging in tactical trading, tactical trading is not part of the Fund's investment process.

Gold is the only currency with intrinsic value and as such qualifies as a hard currency. Gold has a track record measured in millenia. In contrast, the current U.S. dollar experiment only dates back to 1971, when Nixon de-linked the U.S. dollar from gold and converted it fully to a modern fiat currency, solely backed by the "faith" of the U.S. government. Central banks have the power to "inflate" in their attempt to spur economic growth. Murray Rothbard, who was the dean of the Austrian School of Economic and Academic Vice President of the Ludwig von Mises Institute, alleges that central banks, rather than smoothing economic cycles, make economic cycles more extreme. Amongst others, Rothbard shows that the Great Depression would have been shorter and less severe had there not been government intervention through ill-conceived monetary and government policies. *

* Rothbard, Murray, 2000, America's Great Depression, 5th edition (first edition 1963), Mises Institute

We couldn't find any questions for your request.

BECOME A PART OF THE

MERK COMMUNITY

Subscribe to our regular reports and research,

as well as all updates relating to MERK

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully. Foreside Fund Services, LLC, distributor.

How to Invest in the Merk Funds

There are 3 ways to invest in the Merk Hard Currency Fund:

- Invest directly with Merk Hard Currency Fund;

Click here to open an account or download forms - Invest through a Broker

- Invest through your Investment Adviser

Merk Hard Currency Fund (MERKX)

The Merk Hard Currency Fund invests in a managed basket of hard currencies from countries with sound monetary policies. This strategy seeks to profit from a rise in hard currencies relative to the U.S. dollar.

If you have any questions pertaining to the Merk Mutual Funds, please read the Mutual Fund Shareholder FAQ

Please contact us or call (866) MERK-FUND for more information on investing in the Merk Funds

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully. Foreside Fund Services, LLC, distributor.

Documents

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully. Foreside Fund Services, LLC, distributor.

Overview

Below is the Fund's exposure to hard currencies as of June 30, 2022, along with the composition of the U.S. Dollar Index (USDX):

| Region | Currency | MERKX | USDX |

|---|---|---|---|

| Europe | Euro | 14.8% | 57.6% |

| Norwegian Krone | 15.7% | — | |

| Swiss Franc | — | 3.6% | |

| British Pound | 3.6% | 11.9% | |

| Swedish Krona | 10.4% | 4.2% | |

| Australasia ex Japan | Australian Dollar | 18.5% | — |

| New Zealand Dollar | 11.8% | — | |

| Singapore Dollar | — | — | |

| Japan | Japanese Yen | — | 13.6% |

| North America | Canadian Dollar | 24.5% | 9.1% |

| US Dollar | — | — | |

| Gold | Gold | 0.8% | — |

The Fund's security holdings as of June 30, 2022 are shown below:

| Holding | Currency | Maturity | Percent of Portfolio |

|---|---|---|---|

| ALBERTA PROVINCE 1.60% | CAD | 9/1/22 | 5.0% |

| AUSTRALIAN GOVERNMENT 2.25% | AUD | 11/21/22 | 5.8% |

| CANADIAN TREASURY BILL | CAD | 7/21/22 | 4.9% |

| CITY OF OSLO NORWAY | NOK | 4/3/24 | 2.1% |

| CITY OF OSLO NORWAY | NOK | 5/24/23 | 2.2% |

| EFSF 1.875% | EUR | 5/23/23 | 4.4% |

| KOMMUNINVEST I SVERIGE 0.75% | SEK | 2/22/23 | 10.3% |

| NEW BRUNSWICK PROVINCE 2.85% | CAD | 6/2/23 | 4.5% |

| NEW SOUTH WALES TREASURY CORP 4.00% | AUD | 4/20/23 | 2.6% |

| NEW ZEALAND GOVERNMENT 5.50% | NZD | 4/15/23 | 11.3% |

| NORWEGIAN TREASURY BILL | NOK | 12/21/22 | 10.0% |

| PROVINCE OF BRITISH COLUMBIA 2.70% | CAD | 12/18/22 | 4.2% |

| QUEENSLAND TREASURY CORP 6.00% | AUD | 7/21/22 | 4.8% |

| REPUBLIC OF AUSTRIA 0% | EUR | 4/20/23 | 4.5% |

| SASKATHEWAN PROVINCE 3.20% | CAD | 6/3/24 | 4.9% |

| TREASURY CORP VICTORIA 6.00% | AUD | 10/17/22 | 2.6% |

| U.S. TREASURY | USD | 7/21/22 | 6.5% |

| VANECK MERK GOLD SHARES | GOLD | 0.8% |

The Fund accepts investments in the following minimum amounts:

| Minimum Initial Investment | Minimum Additional Investment | |

|---|---|---|

| Standard Accounts | $2,500 | $100 |

| Traditional and Roth IRA Accounts | $1,000 | $100 |

Fund Information

Ticker

MERKX

Expense Ratio

1.32%

Assets

Assets reflect investor and institutional shares combined.

$46.3 million (as of 06/30/22)

Dividends

Duration

To mitigate interest rate and credit risk to its portfolio, the Fund typically maintains a weighted average portfolio maturity of less than eighteen months.

0.57 years

Fund Inception

May 10th, 2005

Load

No-Load Fund

Institutional Shares

Merk Funds provides an institutional share class for the Merk Hard Currency Fund (MHCIX). The institutional shares eliminate the 12b-1 fee and have a minimum investment of $250,000, which may be aggregated across multiple client accounts for advisers.

Available

Portfolio Managers

President & Chief Investment Officer

Supported by the Investment Management Team

Below is the Fund's exposure to hard currencies as of June 30, 2022, along with the composition of the U.S. Dollar Index (USDX):

| Region | Currency | MERKX | USDX |

|---|---|---|---|

| Europe | Euro | 14.8% | 57.6% |

| Norwegian Krone | 15.7% | — | |

| Swiss Franc | — | 3.6% | |

| British Pound | 3.6% | 11.9% | |

| Swedish Krona | 10.4% | 4.2% | |

| Australasia ex Japan | Australian Dollar | 18.5% | — |

| New Zealand Dollar | 11.8% | — | |

| Singapore Dollar | — | — | |

| Japan | Japanese Yen | — | 13.6% |

| North America | Canadian Dollar | 24.5% | 9.1% |

| US Dollar | — | — | |

| Gold | Gold | 0.8% | — |

The Fund's security holdings as of June 30, 2022 are shown below:

| Holding | Currency | Maturity | Percent of Portfolio |

|---|---|---|---|

| ALBERTA PROVINCE 1.60% | CAD | 9/1/22 | 5.0% |

| AUSTRALIAN GOVERNMENT 2.25% | AUD | 11/21/22 | 5.8% |

| CANADIAN TREASURY BILL | CAD | 7/21/22 | 4.9% |

| CITY OF OSLO NORWAY | NOK | 4/3/24 | 2.1% |

| CITY OF OSLO NORWAY | NOK | 5/24/23 | 2.2% |

| EFSF 1.875% | EUR | 5/23/23 | 4.4% |

| KOMMUNINVEST I SVERIGE 0.75% | SEK | 2/22/23 | 10.3% |

| NEW BRUNSWICK PROVINCE 2.85% | CAD | 6/2/23 | 4.5% |

| NEW SOUTH WALES TREASURY CORP 4.00% | AUD | 4/20/23 | 2.6% |

| NEW ZEALAND GOVERNMENT 5.50% | NZD | 4/15/23 | 11.3% |

| NORWEGIAN TREASURY BILL | NOK | 12/21/22 | 10.0% |

| PROVINCE OF BRITISH COLUMBIA 2.70% | CAD | 12/18/22 | 4.2% |

| QUEENSLAND TREASURY CORP 6.00% | AUD | 7/21/22 | 4.8% |

| REPUBLIC OF AUSTRIA 0% | EUR | 4/20/23 | 4.5% |

| SASKATHEWAN PROVINCE 3.20% | CAD | 6/3/24 | 4.9% |

| TREASURY CORP VICTORIA 6.00% | AUD | 10/17/22 | 2.6% |

| U.S. TREASURY | USD | 7/21/22 | 6.5% |

| VANECK MERK GOLD SHARES | GOLD | 0.8% |

The Fund accepts investments in the following minimum amounts:

| Minimum Initial Investment | Minimum Additional Investment | |

|---|---|---|

| Standard Accounts | $2,500 | $100 |

| Traditional and Roth IRA Accounts | $1,000 | $100 |

BECOME A PART OF THE

MERK COMMUNITY

Subscribe to our regular reports and research,

as well as all updates relating to MERK

Currency symbols: AUD Australian dollar; CAD Canadian dollar; CHF Swiss Franc; EUR euro; GBP British pound; JPY Japanese yen; NOK Norwegian krone; NZD New Zealand dollar; SGD Singapore dollar; SEK Swedish krona; USD U.S. dollar

Fund holdings are subject to change without notice.

Currency exposure includes unsettled trades, market or accrued cost value of debt securities held, money market deposit account, capital shares sold, accrued income, as well as effective exposure through currency forward contracts, if applicable. US Dollar, net, includes net other assets and liabilities. All percentages are of total net assets. Top holdings currency exposure is before settlements, if any. Sector allocation adheres to balance sheet classifications and makes no adjustment for gold futures exposure. Please also consult with the latest annual or semi-annual report for complete information on assets, liabilities and applicable notes as of the publication date for the respective reports.

The ICE U.S. Dollar Index® (USDX) is a trade-weighted geometric average of the U.S. dollar’s value compared to a basket of six major global currencies (euro, Japanese yen, British pound, Canadian dollar, Swedish krona, Swiss franc) set by the ICE (IntercontinentalExchange) Futures US. It is not possible to invest directly in an index.

As with any mutual fund product, there is no guarantee that the fund will achieve its goals. Investment return and principal value will vary and shares may be worth more or less at redemption than at original purchase; the Fund is not a substitute for a money market fund. Investors should consider the investment objectives, risks and charges and expenses of the Merk Hard Currency Fund carefully before investing.

The prospectus contains this and other information about the Merk Hard Currency Fund. To obtain a prospectus, please download it now or call (866) MERK FUND. The prospectus should be read carefully before investing.

Merk Hard Currency Fund Disclosure:

The material must be preceded or accompanied by a prospectus. Before investing you should carefully consider the VanEck Merk Gold Trust's ("Trust") investment objectives, risks, charges and expenses.

Investing involves risk, including possible loss of principal. The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity pool for the purposes of the Commodity Exchange Act. Shares of the Trust are not subject to the same regulatory requirements as mutual funds. Because shares of the Trust are intended to reflect the price of the gold held in the Trust, the market price of the shares is subject to fluctuations similar to those affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value (“NAV”). Brokerage commissions will reduce returns.

The request for redemption of shares for gold is subject to a number of risks including but not limited to the potential for the price of gold to decline during the time between the submission of the request and delivery. Delivery may take a considerable amount of time depending on your location.

Commodities and commodity-index linked securities may be affected by changes in overall market movements and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities.

Trust shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of Trust shares relates directly to the value of the gold held by the Trust (less its expenses), and fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them. The Trust does not generate any income, and as the Trust regularly issues shares to pay for the Sponsor’s ongoing expenses, the amount of gold represented by each Share will decline over time. Investing involves risk, and you could lose money on an investment in the Trust. For a more complete discussion of the risk factors relative to the Trust, carefully read the prospectus.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

The sponsor of the Trust is Merk Investments LLC (the “Sponsor”). VanEck provides marketing services to the Trust.

All rights reserved. All trademarks, service marks or registered trademarks are the property of their respective owners.

VanEck Merk Gold Trust Disclosure:

The material must be preceded or accompanied by a prospectus. Before investing, you should carefully consider the VanEck Merk Gold Trust's ("Trust") investment objectives, risks, charges, and expenses.

Investing involves risk, including possible loss of principal. The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity pool for the purposes of the Commodity Exchange Act. Shares of the Trust are not subject to the same regulatory requirements as mutual funds. Because shares of the Trust are intended to reflect the price of the gold held in the Trust, the market price of the shares is subject to fluctuations similar to those affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value (“NAV”). Brokerage commissions will reduce returns.

The request for redemption of shares for gold is subject to a number of risks including but not limited to the potential for the price of gold to decline during the time between the submission of the request and delivery. Delivery may take a considerable amount of time depending on your location.

Commodities and commodity-index linked securities may be affected by changes in overall market movements and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities.

Trust shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of Trust shares relates directly to the value of the gold held by the Trust (less its expenses), and fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them. The Trust does not generate any income, and as the Trust regularly issues shares to pay for the Sponsor’s ongoing expenses, the amount of gold represented by each Share will decline over time. Investing involves risk, and you could lose money on an investment in the Trust. For a more complete discussion of the risk factors relative to the Trust, carefully read the prospectus.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

The sponsor of the Trust is Merk Investments LLC (the “Sponsor”). VanEck provides marketing services to the Trust.

All rights reserved. All trademarks, service marks or registered trademarks are the property of their respective owners.

This internet site is not an offer to sell or a solicitation of an offer to buy shares of the Funds to any person in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Furthermore, this site contains links to third party websites on the internet. The inclusion of such links on the site are not endorsement by the Funds, implied or otherwise, of the linked site or any products or services in such sites, and no information in such site has been endorsed or approved by the Funds.

The linked sites are not under the control of the Funds, and the Funds are not responsible for the contents of any linked site or any link contained in a linked site. For additional information pertaining to the use of this site, refer to the Terms and Conditions of Use link found below.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully. Foreside Fund Services, LLC, distributor.

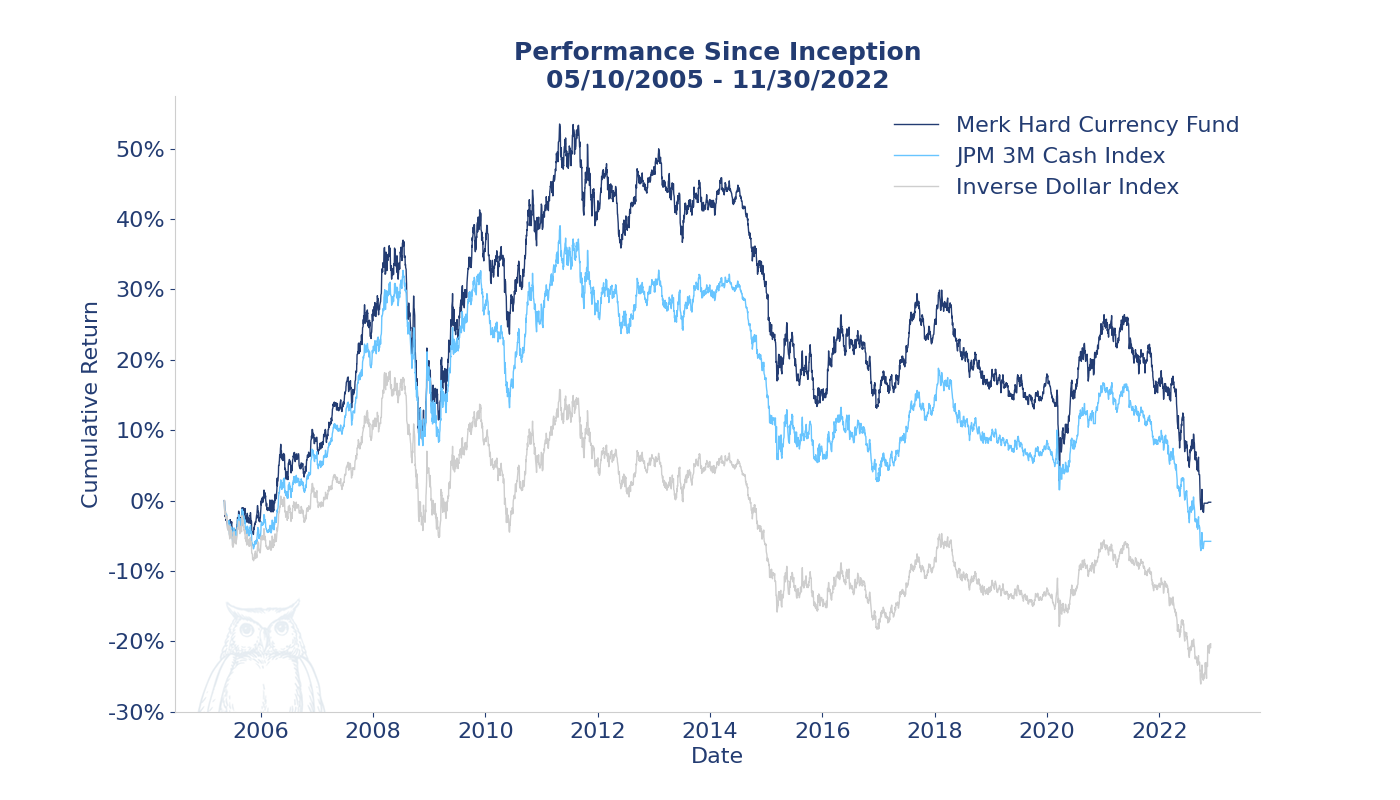

Performance

The Merk Hard Currency Fund invests in a managed basket of hard currencies from countries with sound monetary policies.

This strategy seeks to profit from a rise in hard currencies relative to the U.S. dollar, which may help to diversify your portfolio, and potentially decreases downside risk against a decline in the dollar.

The Merk Hard Currency Fund provides access to these currencies, while seeking to mitigate stock market, credit and interest rate risks incurred by alternative means of access, such as the typical international equity or bond fund.

The performance numbers below are for Investor Shares.

Month End: As of November 30, 2022

| YTD | 1 year | Since inception 5/10/05 (Cumulative Returns) |

|

|---|---|---|---|

| MERKX | -15.03% | -14.25% | -0.22% |

| Inverse of USDX | -13.66% | -12.88% | -5.78% |

| JPM 3M Cash Index | -9.76% | -9.53% | -20.34% |

Quarter End: As of November 30, 2022 (annualized returns)

| 1 year | 5 year | 10 year | Since inception 5/10/05 | |

|---|---|---|---|---|

| MERKX | -14.25% | -4.20% | -3.71% | -0.01% |

| Inverse of USDX | -12.88% | -3.67% | -3.15% | -0.34% |

| JPM 3M Cash Index | -9.53% | -2.58% | -2.76% | -1.29% |

Calendar Year Performance

| MERKX | Inverse of USDX | JPM 3M Cash Index | |

|---|---|---|---|

| 2021 | -6.37% | -5.99% | -6.30% |

| 2020 | 6.27% | 7.17% | 7.29% |

| 2019 | 0.87% | -0.22% | -0.53% |

| 2018 | -6.33% | -4.21% | -4.78% |

| 2017 | 9.08% | 10.95% | 10.24% |

| 2016 | -0.33% | -3.50% | -2.86% |

| 2015 | -12.08% | -8.48% | -7.94% |

| 2014 | -8.94% | -11.34% | -10.37% |

| 2013 | -2.76% | -0.33% | -0.04% |

| 2012 | 4.11% | 0.51% | 2.27% |

| 2011 | -0.77% | -1.43% | 0.77% |

| 2010 | 4.63% | -1.48% | 0.25% |

| 2009 | 13.84% | 4.43% | 9.00% |

| 2008 | -4.94% | -5.67% | -3.22% |

| 2007 | 15.18% | 9.06% | 13.79% |

| 2006 | 11.67% | 8.99% | 12.13% |

Dividend History

The Fund declares distributions from net investment income quarterly. Any net capital gain realized by the Fund will be distributed at least annually.

Net investment income includes, amongst others, interest income net of Fund expenses. Foreign exchange gains and losses may influence net investment income. As a result, the net investment income paid and the Fund's yield as published in databases may not be a reflection of the yields of securities invested in.

Separately, when there are foreign exchange losses, the net income distributed may be significantly reduced or eliminated. Also note that foreign exchange gains may be offset by foreign exchange losses later in the year; as a consequence, and influenced by IRS rules, the bulk of realized currency gains will factor into net income distributions in December (end of calendar year) and March (end of fiscal year).

| Record Date | Ex Date | Pay Date | Investor Shares | Institutional Shares | |

|---|---|---|---|---|---|

| Income | 9/28/22 | 9/29/22 | 9/30/22 | $0.00 | $0.00 |

| Income | 6/28/22 | 6/29/22 | 6/30/22 | $0.00 | $0.00 |

| Income | 3/29/22 | 3/30/22 | 3/31/22 | $0.00 | $0.00 |

| Income | 12/29/21 | 12/30/21 | 12/31/21 | $0.22 | $0.24 |

| Short Term | 12/13/21 | 12/14/21 | 12/15/21 | $0.00 | $0.00 |

| Long Term | 12/13/21 | 12/14/21 | 12/15/21 | $0.00 | $0.00 |

| Income | 9/28/21 | 9/29/21 | 9/30/21 | $0.00 | $0.00 |

| Income | 6/28/21 | 6/29/21 | 6/30/21 | $0.00 | $0.00 |

| Income | 3/29/21 | 3/30/21 | 3/31/21 | $0.00 | $0.00 |

| Income | 12/29/20 | 12/30/20 | 12/31/20 | $0.00 | $0.00 |

| Short Term | 12/10/20 | 12/11/20 | 12/14/20 | $0.00 | $0.00 |

| Long Term | 12/10/20 | 12/11/20 | 12/14/20 | $0.00 | $0.00 |

| Income | 9/28/20 | 9/29/20 | 9/30/20 | $0.00 | $0.00 |

| Income | 6/26/20 | 6/29/20 | 6/30/20 | $0.00 | $0.00 |

| Income | 3/27/20 | 3/30/20 | 3/31/20 | $0.00 | $0.00 |

| Income | 12/27/19 | 12/30/19 | 12/31/19 | $0.00 | $0.00 |

| Short Term | 12/12/19 | 12/13/19 | 12/16/19 | $0.00 | $0.00 |

| Long Term | 12/12/19 | 12/13/19 | 12/16/19 | $0.00 | $0.00 |

| Income | 9/26/19 | 9/27/19 | 9/30/19 | $0.00 | $0.00 |

| Income | 6/26/19 | 6/27/19 | 6/28/19 | $0.00 | $0.00 |

| Income | 3/27/19 | 3/28/19 | 3/29/19 | $0.00 | $0.00 |

| Income | 12/27/18 | 12/28/18 | 12/31/18 | $0.00 | $0.00 |

| Income | 9/26/18 | 9/27/18 | 9/28/18 | $0.00 | $0.00 |

| Income | 6/27/18 | 6/28/18 | 6/29/18 | $0.08 | $0.09 |

| Income | 3/27/18 | 3/28/18 | 3/29/18 | $0.09 | $0.12 |

| Income | 12/27/17 | 12/28/17 | 12/29/17 | $0.00 | $0.00 |

| Short Term | 12/14/17 | 12/15/17 | 12/18/17 | $0.00 | $0.00 |

| Long Term | 12/14/17 | 12/15/17 | 12/18/17 | $0.00 | $0.00 |

| Income | 9/27/17 | 9/28/17 | 9/29/17 | $0.00 | $0.00 |

| Income | 6/28/17 | 6/29/17 | 6/30/17 | $0.00 | $0.00 |

| Income | 3/29/17 | 3/30/17 | 3/31/17 | $0.00 | $0.00 |

| Income | 12/28/16 | 12/29/16 | 12/30/16 | $0.00 | $0.00 |

| Short Term | 12/14/16 | 12/15/16 | 12/16/16 | $0.00 | $0.00 |

| Long Term | 12/14/16 | 12/15/16 | 12/16/16 | $0.00 | $0.00 |

| Income | 9/28/16 | 9/29/16 | 9/30/16 | $0.00 | $0.00 |

| Income | 6/28/16 | 6/29/16 | 6/30/16 | $0.00 | $0.00 |

| Income | 3/29/16 | 3/30/16 | 3/31/16 | $0.00 | $0.00 |

| Income | 12/29/15 | 12/30/15 | 12/31/15 | $0.00 | $0.00 |

| Short Term | 12/14/15 | 12/15/15 | 12/16/15 | $0.00 | $0.00 |

| Long Term | 12/14/15 | 12/15/15 | 12/16/15 | $0.00 | $0.00 |

| Income | 9/28/15 | 9/29/15 | 9/30/15 | $0.00 | $0.00 |

| Income | 6/26/15 | 6/29/15 | 6/30/15 | $0.00 | $0.00 |

| Income | 3/27/15 | 3/30/15 | 3/31/15 | $0.00 | $0.00 |

| Income | 12/29/14 | 12/30/14 | 12/31/14 | $0.00 | $0.00 |

| Short Term | 12/11/14 | 12/12/14 | 12/15/14 | $0.00 | $0.00 |

| Long Term | 12/11/14 | 12/12/14 | 12/15/14 | $0.00 | $0.00 |

| Income | 9/26/14 | 9/29/14 | 9/30/14 | $0.00 | $0.00 |

| Income | 6/26/14 | 6/27/14 | 6/30/14 | $0.08 | $0.09 |

| Income | 3/27/14 | 3/28/14 | 3/31/14 | $0.06 | $0.07 |

| Income | 12/27/13 | 12/30/13 | 12/31/13 | $0.00 | $0.00 |

| Short Term | 12/11/13 | 12/12/13 | 12/13/13 | $0.00 | $0.00 |

| Long Term | 12/11/13 | 12/12/13 | 12/13/13 | $0.00 | $0.00 |

| Income | 9/26/13 | 9/27/13 | 9/30/13 | $0.00 | $0.00 |

| Income | 6/26/13 | 6/27/13 | 6/28/13 | $0.00 | $0.00 |

| Income | 3/26/13 | 3/27/13 | 3/28/13 | $0.00 | $0.00 |

| Income | 12/27/12 | 12/28/12 | 12/31/12 | $0.00 | $0.00 |

| Short Term | 12/12/12 | 12/13/12 | 12/14/12 | $0.00 | $0.00 |

| Long Term | 12/12/12 | 12/13/12 | 12/14/12 | $0.11 | $0.11 |

| Income | 9/26/12 | 9/27/12 | 9/28/12 | $0.00 | $0.00 |

| Income | 6/27/12 | 6/28/12 | 6/29/12 | $0.00 | $0.00 |

| Income | 3/28/12 | 3/29/12 | 3/30/12 | $0.00 | $0.00 |

| Income | 12/28/11 | 12/29/11 | 12/30/11 | $0.10 | $0.11 |

| Short Term | 12/12/11 | 12/13/11 | 12/14/11 | $0.02 | $0.02 |

| Long Term | 12/12/11 | 12/13/11 | 12/14/11 | $0.16 | $0.16 |

| Income | 9/28/11 | 9/29/11 | 9/30/11 | $0.00 | $0.00 |

| Income | 6/28/11 | 6/29/11 | 6/30/11 | $0.05 | $0.06 |

| Income | 3/29/11 | 3/30/11 | 3/31/11 | $0.05 | $0.07 |

| Income | 12/29/10 | 12/30/10 | 12/31/10 | $0.00 | $0.00 |

| Short Term | 12/8/10 | 12/9/10 | 12/10/10 | $0.01 | $0.01 |

| Long Term | 12/8/10 | 12/9/10 | 12/10/10 | $0.12 | $0.12 |

| Income | 9/28/10 | 9/29/10 | 9/29/10 | $0.00 | $0.00 |

| Income | 6/28/10 | 6/29/10 | 6/29/10 | $0.07 | $0.08 |

| Income | 3/29/10 | 3/30/10 | 3/30/10 | $0.07 | |

| Income | 12/29/09 | 12/30/09 | 12/30/09 | $0.07 | |

| Capital Gains | 12/9/09 | 12/10/09 | 12/11/09 | $0.07 | |

| Income | 9/28/09 | 9/30/09 | 9/30/09 | $0.00 | |

| Income | 6/26/09 | 6/29/09 | 6/29/09 | $0.00 | |

| Income | 3/27/09 | 3/30/09 | 3/30/09 | $0.00 | |

| Income | 12/30/08 | 12/31/08 | 12/31/08 | $0.00 | |

| Capital Gains | 12/9/08 | 12/10/08 | 12/10/08 | $0.03 | |

| Income | 9/26/08 | 9/29/08 | 9/29/08 | $0.00 | |

| Income | 6/26/08 | 6/27/08 | 6/27/08 | $0.15 | |

| Income | 3/27/08 | 3/28/08 | 3/28/08 | $0.20 | |

| Income | 12/28/07 | 12/31/07 | 12/31/07 | $0.42 | |

| Capital Gains | 12/11/07 | 12/12/07 | 12/12/07 | $0.03 | |

| Income | 9/27/07 | 9/28/07 | 9/28/07 | $0.05 | |

| Income | 6/28/07 | 6/29/07 | 6/29/07 | $0.06 | |

| Income | 3/29/07 | 3/30/07 | 3/30/07 | $0.09 | |

| Income | 12/28/06 | 12/29/06 | 12/29/06 | $0.21 | |

| Capital Gains | 12/11/06 | 12/12/06 | 12/12/06 | $0.00 | |

| Income | 9/28/06 | 9/29/06 | 9/29/06 | $0.04 | |

| Income | 6/29/06 | 6/30/06 | 6/30/06 | $0.02 | |

| Capital Gains | 12/12/05 | 12/13/05 | 12/13/05 | $0.01 |

†The Merk Hard Currency Fund re-designated 1.91% and 12.81% of total 2008 net investment income distributions as short-term capital gain and long-term capital gain, respectively. This information is provided for informational purposes only and should not be used for tax reporting.

Performance data represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost.

BECOME A PART OF THE

MERK COMMUNITY

Subscribe to our regular reports and research,

as well as all updates relating to MERK

The ICE U.S. Dollar Index® (USDX) is a trade-weighted geometric average of the U.S. dollar’s value compared to a basket of six major global currencies (euro, Japanese yen, British pound, Canadian dollar, Swedish krona, Swiss franc) set by the ICE (IntercontinentalExchange) Futures US. It is not possible to invest directly in an index.

The J.P. Morgan 3-Month Global Cash Index (expressed in USD) is an equal-weighted aggregate of the cash indices of 13 countries. Each country's cash index measures the total return of a notional, rolling, daily investment in a 3-month constant maturity deposit in such country's currency. Indices cannot be purchased directly by investors.

As with any investment strategy, there is no guarantee we will achieve this goal and the strategy may not be suitable for every investor. The Fund is not a substitute for a money market fund. The prospectus should be read carefully before investing.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully. Foreside Fund Services, LLC, distributor.

Investment Process

Under normal market conditions, the Fund invests at least 80% of the value of its net assets (plus borrowings for investment purposes) in “hard currency” denominated investments. Hard currencies are currencies of countries pursuing what Merk Investments LLC (the “Adviser”) believes to be “sound” monetary policy and gold.

Sound monetary policy is defined by the Adviser as providing an environment fostering long-term price stability. Due to the intrinsic value of gold, the Adviser considers gold to qualify as a hard currency.

The Fund normally invests in a managed basket of hard currency denominated, high quality, short-term debt instruments, including sovereign debt and gold. To the extent that the Fund invests in gold, it will normally do so indirectly through U.S. listed exchange-traded products (“ETPs”) that invest in gold bullion and futures contracts, including ETPs sponsored by the Adviser or its affiliates.

BECOME A PART OF THE

MERK COMMUNITY

Subscribe to our regular reports and research,

as well as all updates relating to MERK

The Adviser will determine currency allocations based on its analysis of monetary policies pursued by central banks and economic environments. The Adviser may adapt the currency allocations as its analysis of monetary policies and economic environments evolves.

The Fund will specifically seek exposure to currencies of countries pursuing what the Adviser believes to be sound monetary policies. As long-term price stability is unlikely to be achieved by most currencies, if any, however, the Adviser may focus on countries with monetary policies that, in the Adviser’s view, better foster such stability. The Fund may from time to time focus its investment in just a few currencies.

To mitigate interest rate and credit risk, the Fund’s fixed income holdings typically have a weighted average portfolio maturity of less than eighteen months. In addition, the Fund only buys money market or other short-term debt instruments that are rated in the top three rating categories by one or more U.S. nationally recognized services or that the Adviser considers to be comparable in quality to such instruments. When selecting debt securities for the portfolio, the Adviser may sacrifice yield for high credit quality.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully. Foreside Fund Services, LLC, distributor.

Frequently Asked Questions

FAQ

The Merk Hard Currency Fund is a mutual fund that invests in a basket of hard currencies from countries with sound monetary policies assembled to protect against a decline in the dollar while seeking to mitigate stock market, credit and interest risks.

Investments in hard currencies seek to protect against a fall in the purchasing power of the dollar and mitigate stock market, credit and interest rate risk.

A classic asset allocation model assumes world financial markets in balance. When the global financial imbalances are severe, asset classes may not perform as historically anticipated. In these times, investors may want to consider moving some of their investments to hard currency.

Investment in hard currency seek to protect against a fall in the purchasing power of the dollar and mitigates stock market, credit and interest rate risk.

Diversification is the practice of reducing investment risk by spreading assets over several categories of investments. The Merk Hard Currency Fund helps you to diversify your portfolio and protect your capital against a decline in the dollar by providing easy access, through the fund, to hard currencies from countries with sound monetary policies.

Under normal market conditions, the Merk Hard Currency Fund invests at least 80% of the value of its net assets in hard currencies. The Fund normally invests in a basket of foreign currencies composed of high-quality, short-term money market instruments of countries pursuing “sound” monetary policy, and indirectly in gold. Currency allocations may be adapted as monetary policies and economic environments evolve.

The Merk Funds publish their currency allocations quarterly; this allocation adapts as our analyses evolve. We use the term "adapt" and "evolve" to emphasize that allocation changes tend to be gradual. Tactical trading refers to short-term trading to take advantage of perceived opportunities. While the Fund is not prevented from engaging in tactical trading, tactical trading is not part of the Fund's investment process.

Gold is the only currency with intrinsic value and as such qualifies as a hard currency. Gold has a track record measured in millenia. In contrast, the current U.S. dollar experiment only dates back to 1971, when Nixon de-linked the U.S. dollar from gold and converted it fully to a modern fiat currency, solely backed by the "faith" of the U.S. government. Central banks have the power to "inflate" in their attempt to spur economic growth. Murray Rothbard, who was the dean of the Austrian School of Economic and Academic Vice President of the Ludwig von Mises Institute, alleges that central banks, rather than smoothing economic cycles, make economic cycles more extreme. Amongst others, Rothbard shows that the Great Depression would have been shorter and less severe had there not been government intervention through ill-conceived monetary and government policies. *

* Rothbard, Murray, 2000, America's Great Depression, 5th edition (first edition 1963), Mises Institute

We couldn't find any questions for your request.

BECOME A PART OF THE

MERK COMMUNITY

Subscribe to our regular reports and research,

as well as all updates relating to MERK

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully. Foreside Fund Services, LLC, distributor.

How to Invest in the Merk Funds

There are 3 ways to invest in the Merk Hard Currency Fund:

- Invest directly with Merk Hard Currency Fund;

Click here to open an account or download forms - Invest through a Broker

- Invest through your Investment Adviser

Merk Hard Currency Fund (MERKX)

The Merk Hard Currency Fund invests in a managed basket of hard currencies from countries with sound monetary policies. This strategy seeks to profit from a rise in hard currencies relative to the U.S. dollar.

If you have any questions pertaining to the Merk Mutual Funds, please read the Mutual Fund Shareholder FAQ

Please contact us or call (866) MERK-FUND for more information on investing in the Merk Funds

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully. Foreside Fund Services, LLC, distributor.

Documents

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully. Foreside Fund Services, LLC, distributor.