Is Stagflation Risk Real?

Axel Merk, Merk Investments

May 17, 2022

A few days ago, I had the pleasure of attending the Hoover Monetary Conference – I would call it a Powwow of central bankers, if there had not been an actual Powwow a few steps outside the venue. While Hoover is known to reflect “hawkish” views, “hawks” and “doves” alike used the question of whether the Fed is “behind the curve” to argue all things inflation and stagflation. I left the conference more concerned about the risk of stagflation; let me explain.

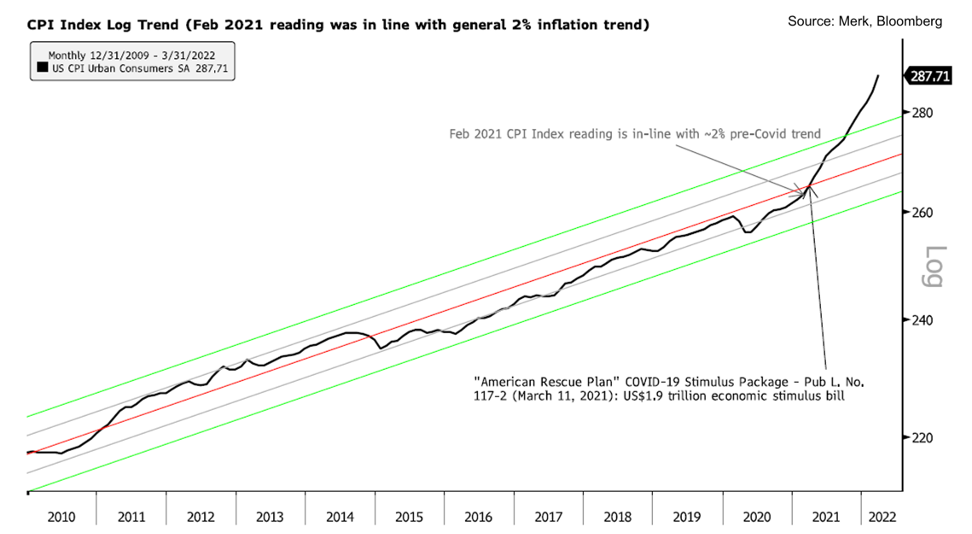

The “hawkish” view was well represented: the Fed has fallen behind, even generous Taylor rule models (an econometric model that describes the relationship between Federal Reserve operating targets and the rates of inflation and gross domestic product growth) suggest rates should be much higher. Former Treasury Secretary, Larry Summers, and Hoover’s John Cochrane and Tyler Goodspeed each showed how they believe fiscal policy (“fiscal helicopter drop”) has been a key contributing factor to the inflationary surge we have seen:

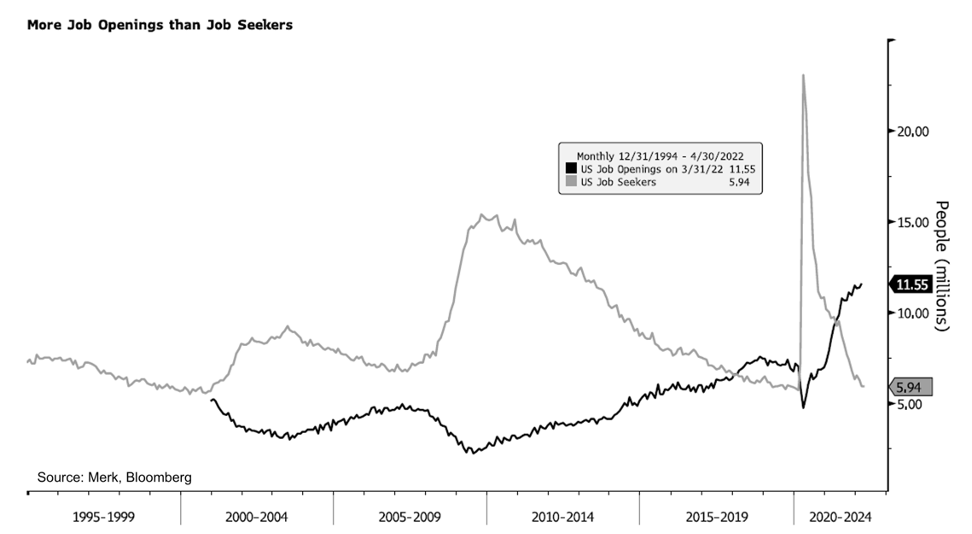

Larry Summers took it several steps further, warning that when you have twice as many job openings as job seekers, you have a job market that is unsustainably hot, and that when monetary policy continues to be accommodative, you are asking for major problems:

Summers argued there needs to be a new framework to have the public regain confidence in the Fed’s inflation fighting abilities.

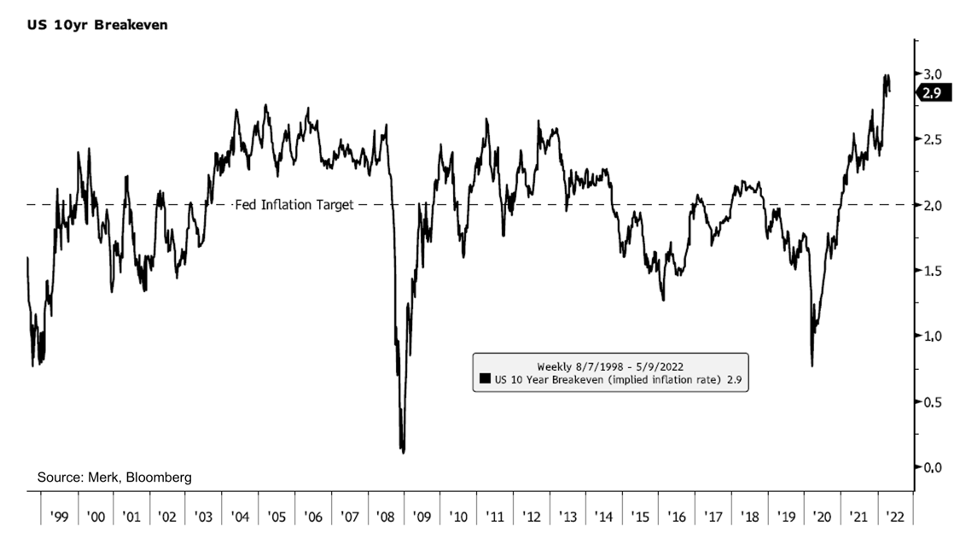

But, but, but…. even hawks acknowledge that while inflation expectations have risen to concerning levels, we are not at a stage where the public has lost confidence in the Fed:

* The breakeven inflation rate represents a measure of expected inflation derived from 10-Year Treasury Securities and 10-Year Treasury Inflation-Indexed Securities.

No one knows where inflation will be a decade from now. The hawks that stipulate that the market still has confidence in the Fed rightfully point to the fact that since no one has a clue what inflation rates will be in the long-run, longer-dated inflation expectations are a measure of confidence in the Fed rather than an actual measure of inflation expectations.

Conversely, the doves point out that inflation expectations of 3% per annum on average only means elevated inflation in the short-run, then back to ‘normal’ in the out-years.

Personally, I consider both the hawkish and dovish scenario plausible, with some big caveats. What the doves miss is that, just because the wheels haven’t fallen off, doesn’t mean there isn’t reason for concern. Of course the market reflects that the Fed will get inflation back under control – otherwise market measures would be very different. However, former Bank of England Governor Mervyn King has suggested it would be helpful for central banks to pursue policies that will contain inflation directly rather than rely on the public’s confidence in central banks’ ability to contain inflation as a matter of policy. The latter risks an unstable dynamic.

Incidentally, at the conference, St. Louis Fed’s Jim Bullard showed that, even with a most benign Taylor rule (John Taylor, co-organizer of the conference, is known for the so-called Taylor rule, a simple formula that suggests where interest rates ought to be), the Fed is significantly “behind the curve.” He then adds that if one doesn’t look at the current Fed funds rate, but what the market prices in over the next two years (i.e., the 2-year yield), the Fed is only a little bit behind the curve.

The latter is what got me worried. It wasn’t just Bullard, but it appears to me that the doves – and those are the ones in charge at the Fed – are perfectly content that the market is pricing in that things will be tighter 2 years out. That market-induced tightening, they argue, is sufficient to get inflation back down.

This “2 years out” theory has the hallmarks of “transitory” – it suggests that inflation surged temporarily, but all will be good down the road if we just keep steady.

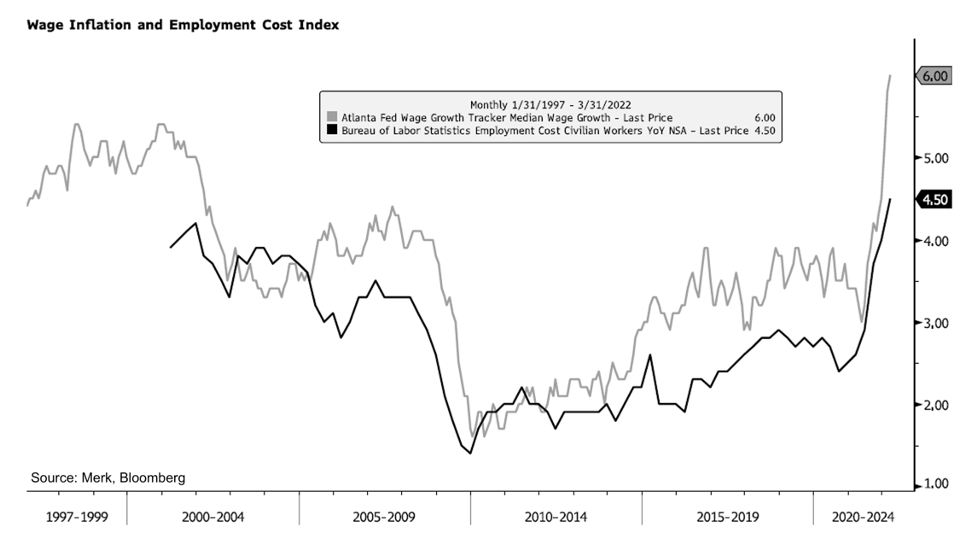

It is of course correct that the market has priced in additional rate hikes and tightening – hence higher 2 year rates. However, they seem to ignore what’s in plain sight and what Larry Summers has warned about: we have twice as many job openings as job seekers. This risks an inflationary spiral as high wage demands lead, at least in part, to broader inflationary pressures.

And there’s of course concern that we not going back to normal. 30% of the world’s grain production is offline which may well cause political instability in parts of the world, to name but one of the more apparent geopolitical risks. Of course we don’t know whether this matters to the U.S., but the question is whether to ignore inflation risks emanating from crises around the world, even as they have already contributed to inflationary pressures.

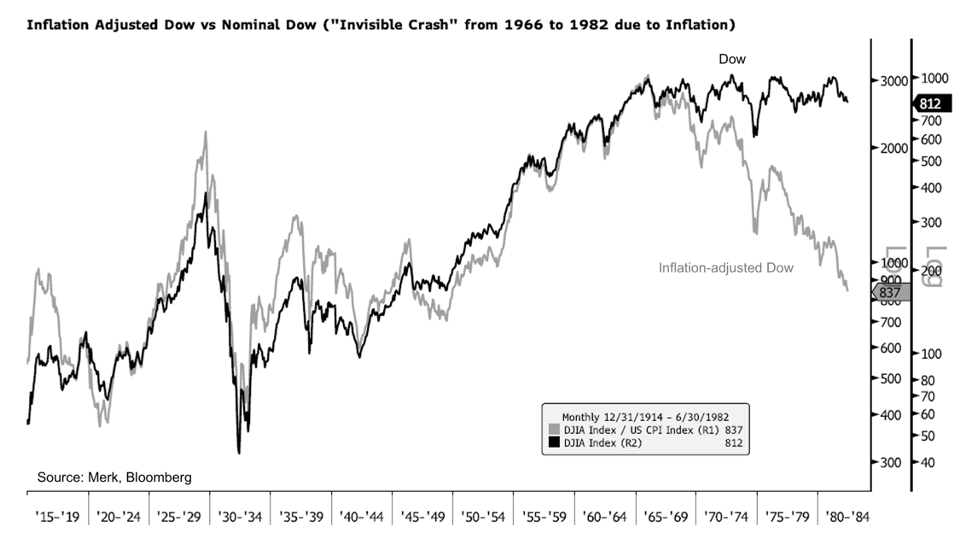

The risk, in my assessment, is that we unleash unstable dynamics. Recent market volatility is no coincidence. Overly accommodative policy may need to be supplemented by rather tight policy; and, in turn, a U-turn in policy may again be in order. In market terms, let’s look at what happened last time inflation was a party pooper – the 1970s. The chart below shows the Dow Jones Industrial Average through the summer of 1982 when Volcker “won” the fight against inflation (for the time being) in black – and then the same Dow adjusted for inflation in grey:

I choose the Dow because of its long history; dividends are not reflected in the chart.

Once unstable dynamics are unleashed, all bets are off as to where the chips will fall. Back to the title of this analysis, the risk of stagflation could increase because the Fed may need to induce a recession, but might be unable to contain inflation.

As some of you already know, at Merk, we have been sufficiently concerned enough about these trends to have recently launched the Merk Stagflation ETF (NYSE:STGF). Check it out at merkfunds.com/stgf.

Axel Merk

President & CIO, Merk Investments

This report was prepared by Merk Investments LLC (“Merk Investments”), and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Merk Investments makes no representation regarding the advisability of investing in the products herein. The information contained herein reflects Merk Investments’ current views and opinions with respect to, among other things, future events and financial performance. Charts, graphs, and tables are provided for illustrative purposes only. Any forward-looking statements contained herein are based on current estimates and expectations. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice and is not intended as an endorsement of any specific investment. The information contained herein is general in nature and is provided solely for educational and informational purposes. Some believe predicting recessions is either impossible or very difficult. The information provided does not constitute legal, financial or tax advice. You should obtain advice specific to your circumstances from your own legal, financial and tax advisors. Past performance is no guarantee of future results.

Stagflation ETF Disclosure:

Principal payments for Treasury Inflation-Protection Securities are adjusted according to changes in the Consumer Price Index (CPI). While this may provide a hedge against inflation, the returns may be relatively lower than those of other securities. Similar to other issuers, changes to the financial condition or credit rating of the U.S. government may cause the value of the Fund's exposure to U.S. Treasury obligations to decline.

The Fund may be sensitive to changes in the price of gold. Real estate is highly sensitive to general and local economic conditions and developments. The U.S. real estate market may experience and has, in the past, experienced a decline in value, with certain regions experiencing significant losses in property values.

Several factors may affect the price of crude oil and, in turn, the WTI crude oil futures contracts. These factors include, but are not limited to, significant increases or decreases in the available supply or demand of crude oil, large purchases or sales of crude oil by governments or large institutions, other political factors such as new regulations or political discord in oil producing countries, as well as a significant increase or decrease in crude oil hedging activity by crude oil producers.

The Fund may be exposed to futures contracts for its commodities investments. The risk of a position in a futures contract may be very large compared to the relatively low level of margin the underlying ETF is required to deposit. In many cases, a relatively small price movement in a futures contract may result in immediate and substantial loss or gain to the investor relative to the size of a required margin deposit. The prices of futures contracts may not correlate perfectly with movements in the securities or index underlying the contract.

The Fund is not actively managed and the Adviser would not sell shares of an equity security due to current or projected underperformance of a security, industry, or sector unless that security is removed from the Index or the selling of shares of that security is otherwise required upon a rebalancing of the Index as addressed in the Index methodology.

ETF shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. NAV returns are calculated using the daily 4:00 pm ET net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by clicking here. Please read the prospectus carefully. Foreside Fund Services, LLC, distributor of the Merk Stagflation ETF.

Index Disclosure:

“Solactive AG (“Solactive”) is the licensor of the Solactive Stagflation Index (the “Index”). The financial instruments that are based on the Index are not sponsored, endorsed, promoted or sold by Solactive in any way and Solactive makes no express or implied representation, guarantee or assurance with regard to: (a) the advisability in investing in the financial instruments; (b) the quality, accuracy and/or completeness of the Index; and/or (c) the results obtained or to be obtained by any person or entity from the use of the Index. Solactive reserves the right to change the methods of calculation or publication with respect to the Index. Solactive shall not be liable for any damages suffered or incurred as a result of the use (or inability to use) of the Index.”